In recent years, the world of investing has witnessed a significant shift with the emergence of cryptocurrencies. These digital assets, powered by revolutionary blockchain technology, have disrupted traditional financial systems and captivated the attention of both seasoned investors and newcomers seeking new opportunities. The allure of potentially high returns and the decentralized nature of cryptocurrencies have drawn millions of people worldwide into the crypto space.

If you’re a new investor eager to explore the exciting world of cryptocurrencies, this comprehensive guide is designed to provide you with essential tips and insights to navigate the landscape confidently. However, it’s crucial to recognize that investing in cryptocurrencies carries both potential rewards and risks, and thus, it requires careful consideration and a thorough understanding of the market dynamics.

1. Educate Yourself

Before delving into the world of cryptocurrencies, take the time to educate yourself about the fundamental concepts and workings of digital assets. Start by understanding what blockchain technology is and how it underpins the entire cryptocurrency ecosystem. Learn about Bitcoin, the pioneering cryptocurrency, and its role as the foundation for most other digital currencies. Familiarize yourself with different types of cryptocurrencies, including altcoins like Ethereum, Ripple, and Litecoin, and their unique use cases.

2. Conduct Extensive Research

Due diligence is paramount in the crypto world. Before investing in any specific cryptocurrency, conduct thorough research to assess its potential. Analyze the project’s whitepaper, which outlines its purpose, technology, and development roadmap. Investigate the team behind the project, their credentials, and their track record. Look for partnerships, community engagement, and real-world applications to gauge the viability of the cryptocurrency in the long term.

3. Diversify Your Portfolio

As with any investment strategy, diversification is key to managing risk. Avoid putting all your funds into a single cryptocurrency. Instead, consider diversifying your portfolio across different digital assets. This approach can help mitigate losses in the event of a downturn in any particular cryptocurrency and increase the likelihood of benefiting from overall market growth.

4. Start Small and Scale Gradually

For new investors, it’s wise to start with a small amount that you can afford to lose. Cryptocurrency markets are notoriously volatile, and prices can fluctuate dramatically in a short period. By starting small, you can gain valuable experience without exposing yourself to significant financial risk. As you become more confident and experienced, you can gradually increase your investment amount.

5. Choose Reliable Exchanges

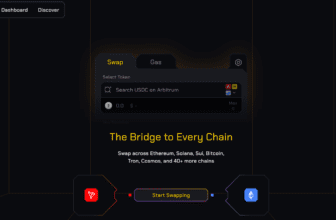

To buy and trade cryptocurrencies, you’ll need to use cryptocurrency exchanges. Choose reputable and established exchanges with a track record of security and reliability. Research user reviews and consider factors like transaction fees, available cryptocurrencies, and customer support before selecting an exchange.

6. Implement Strong Security Measures

Securing your cryptocurrencies is of utmost importance. Use strong and unique passwords for your accounts and enable two-factor authentication (2FA) whenever possible. Consider using hardware wallets or cold storage solutions for long-term holdings to reduce the risk of hacking or cyber theft.

7. Stay Informed and Be Patient

The cryptocurrency market can be highly dynamic, and prices can experience significant fluctuations driven by various factors, including market sentiment, regulatory news, and technological developments. Stay informed about the latest industry trends and news, but also practice patience in your investment approach. Avoid making hasty decisions based on short-term market movements and focus on the long-term potential of your chosen cryptocurrencies.

Don’t Miss: Ethereum Smart Contract: Unlocking the Power of Decentralized Applications

Conclusion

Investing in cryptocurrencies offers exciting opportunities for new investors to participate in a rapidly evolving digital landscape. However, it’s vital to approach this space with caution and a commitment to ongoing learning and research. By educating yourself, conducting thorough research, diversifying your portfolio, starting small, and employing strong security measures, you can set yourself up for a rewarding crypto investment journey. Remember, the key to success lies in staying informed, exercising patience, and making well-informed decisions as you navigate the world of investing in cryptocurrencies.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial or investment advice. Cryptocurrency investments are subject to market risks, and individuals should seek professional advice before making any investment decisions.