Delta Exchange: Key Features for Seamless Crypto Futures and Options Trading

India is the leading nation in crypto adoption and innovation, with 100 million users exploring digital assets for active trading (not just HODLing). Crypto derivatives – futures and options – are seeing a sharp rise in popularity as traders seek better ways to manage risk and enhance returns. In this evolving ecosystem, choosing the right trading platform can largely impact your returns and risk management.

Among hundreds of exchanges in the market, Delta Exchange has emerged as a go-to destination for both novice and experienced traders. With its Financial Intelligence Unit (FIU) of India registration, it adds an extra layer of safety and regulatory compliance. From streamlined transactions to a wide variety of trading contracts, the platform offers a seamless experience for all.

In this post, we’ll discuss the most useful features of Delta Exchange, setting it apart from anyone looking to trade crypto derivatives confidently and efficiently.

Delta Exchange: Key Features for Crypto Futures and Options Trading

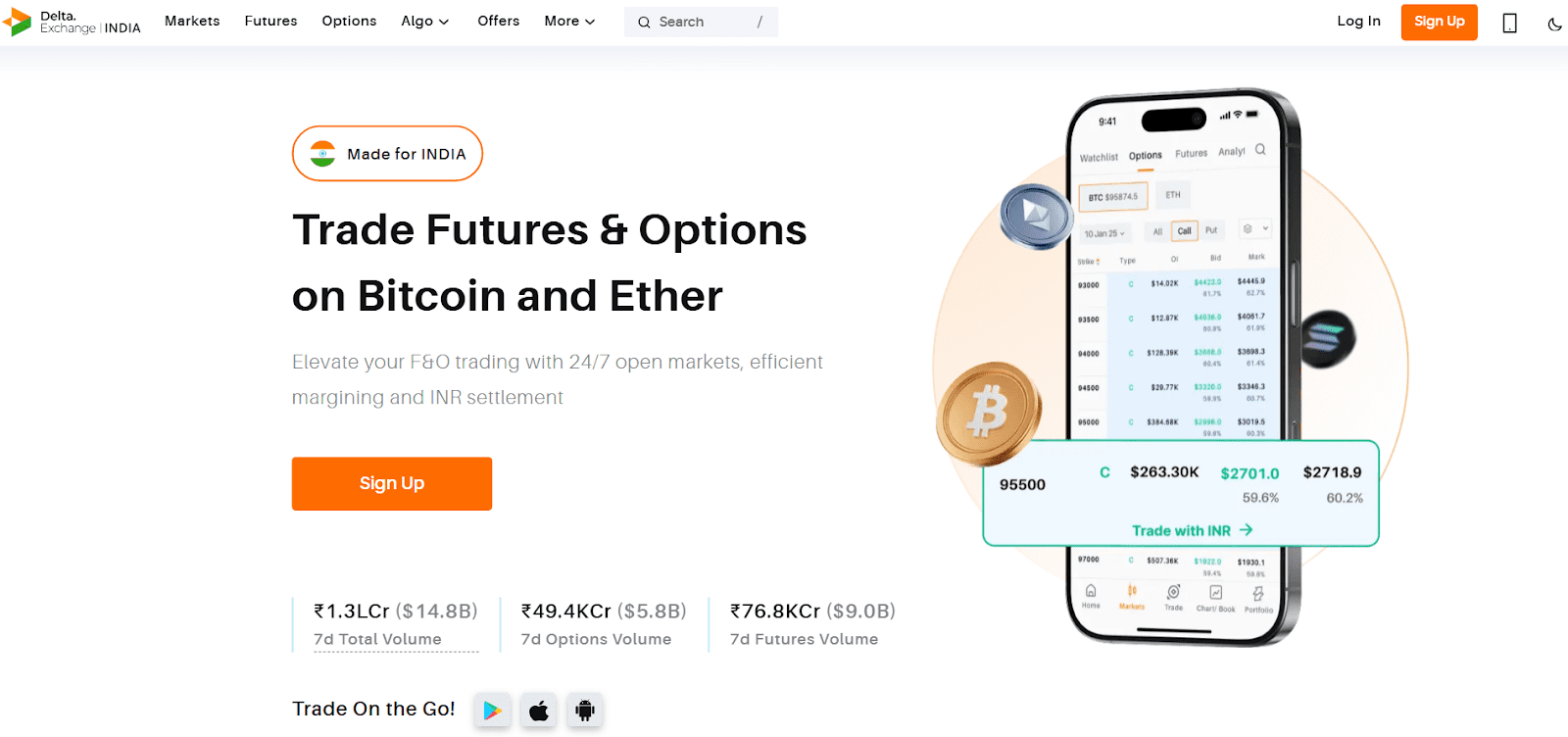

Delta Exchange has become the most popular choice in India’s growing crypto derivatives market, especially for those interested in futures and options trading. Whether you’re managing high-volume positions or testing your risks, the platform offers a mix of simplicity and control.

Source | Delta Exchange leading the way in crypto futures and options trading

Here are some top features of Delta Exchange:

- INR-backed trading experience

One of the platform’s most useful features is the option to trade directly in INR. You don’t have to worry about currency conversion or third-party wallets. The onboarding process is smooth – you can deposit INR using regular payment methods, start futures and options trading, and even withdraw directly in rupees.

This makes transactions faster, cleaner, and more cost-efficient. It also allows you to track your portfolio growth in your local currency, eliminating the need for currency conversions. For many users, this feature eliminates unnecessary complications and offers a more grounded, localised experience.

- Demo mode

If you’re new to the crypto space, it’s natural you wouldn’t want to jump in with real money right away, and that’s where Delta’s demo mode comes into the picture. This feature gives you a near-identical trading environment, but without the real risk.

You can experiment with leverage, test strategies, and explore the platform’s product suite using virtual funds. If you’re a beginner, you can learn the basics, and if you’re a seasoned trader, you can experiment with new strategies. Demo mode allows you to explore crypto futures and options trading safely, while getting familiar with the interface and execution tools before making live trades.

- Leverage and hedging control

Delta Exchange gives you significant control over your assets. You can use leverage up to 100x on certain contracts, which means even small capital can be scaled for larger trades.

For example, if you put ₹1,000 into a position with 50x leverage, you can trade as if you had ₹50,000. Now, if the price moves in your favour – even slightly – you could see strong returns. But this works both ways. If the market moves against you, it could wipe out your position entirely, resulting in a loss.

Delta also provides tools to set stop-loss orders and margin controls, allowing you to limit downside risk without manually monitoring every market move, making it easier for you to keep track of your investments.

- Automation tools

Crypto derivatives markets move 24/7, but that doesn’t mean you need to stay glued to your screen. Delta Exchange offers automated trading bots that help you execute trades based on predefined conditions.

This includes basket orders, which allow you to place multiple trades with margin benefits, and deep OTM/ITM contracts with set expiries. Another feature is the Strategy Builder, which allows you to create and analyse complex cryptocurrency trading strategies via payoff charts.

These tools aren’t limited to tech-savvy traders – anyone who wants more control can use them. Automation helps capitalise on market opportunities, especially when you’re away from your screen.

- Versatile product range

Delta Exchange offers futures and options contracts for several cryptocurrencies – Bitcoin, Ethereum, Ripple, and many other altcoins, with daily, weekly, and monthly expiries. This provides you with the flexibility to pursue either short-term or long-term strategies, depending on your needs.

If you’re interested in hedging, scalping, or even just observing market sentiment, the variety helps. This kind of product range means you’re not restricted to major tokens and can build a more diversified, agile crypto derivatives portfolio using a single platform.

What are the fees on Delta Exchange?

Delta keeps its fee structure simple and transparent. You can start small with BTC contracts from around ₹5,000 and ETH contracts from ₹2,500, making it easier for newer traders to test strategies without needing a large capital outlay.

Source | Trade futures and options on BTC with affordable fees

Crypto futures trades come with a 0.05% taker fee and 0.02% maker fee, while options trades charge 0.03% for both makers and takers. An 18% GST is applied to all trading fees, and for options, the fee is capped at 10% of the premium, making it more cost-efficient during high-volume trades.

Final Thoughts

Picking the right crypto trading platform isn’t just about features – it’s about reliability and how well it fits your trading style. Delta Exchange positions itself in the centre of crypto growth, where functionality meets usability. The Delta Exchange app makes trading accessible wherever you are, on your Android and iOS devices. The app lets you monitor markets, adjust positions, and execute orders on the go.

You can sign up in a few steps and start trading within minutes – no hassle or waiting time. If you’re serious about crypto futures and options trading, Delta is a good platform to begin with.

Read Also: US Debt at $36.6T: Will Bitcoin Return to $95K?

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial or investment advice. Cryptocurrency investments are subject to market risks, and individuals should seek professional advice before making any investment decisions.