Crypto F&O Trading Infrastructure Pioneered by Delta Exchange in India

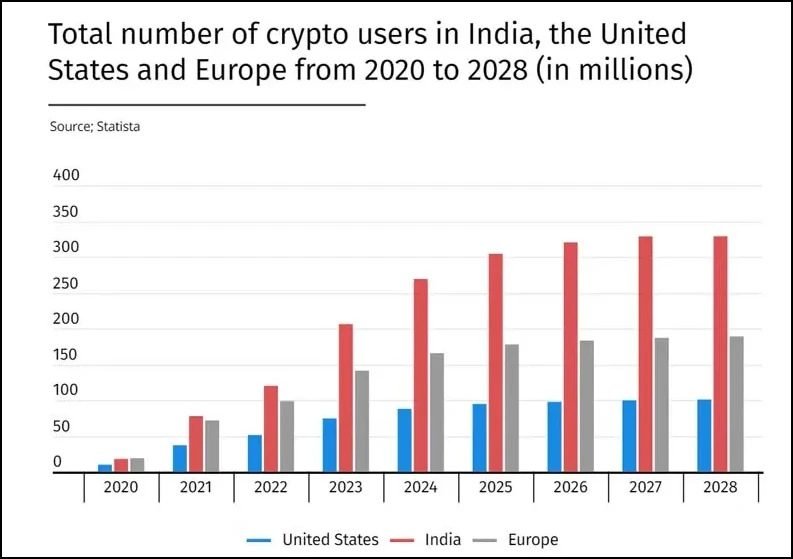

A recent Statista report by AltIndex reveals that India is set to lead the world in crypto adoption, with an estimated 330 million users by 2028, outpacing both the US and Europe. By 2028, one in every three crypto users globally will be from India.

The data clearly shows the country’s growing dominance in the crypto space. As more people enter the crypto market, many are looking for greater flexibility and control in their trades. If you’re one of them, crypto options trading could be the perfect opportunity for you to explore.

To get you started with options trading, Delta Exchange India stands out as a pioneer in building a strong infrastructure for crypto derivatives trading. In this blog, you will get an overview on what crypto options trading actually is and how Delta Exchange makes it easy and accessible for beginners and experts alike.

What is Crypto Options Trading?

Before we get into Delta Exchange’s unique features, let’s first understand what crypto options trading is. Simply put, it’s a way to buy or sell the right (but not the obligation) to trade cryptocurrencies at a specific price on or before a set date.

Here’s an example to make it simple:

- Imagine Bitcoin is currently priced at Rs. 25,00,000.

- You think its price will rise to Rs. 28,00,000 in a week, so you buy a call option that gives you the right to buy Bitcoin at Rs. 26,00,000.

A “call option” gives you the right to buy an asset at a specified price (the strike price) before or on a certain date. It’s used when you believe the price of the asset will go up.

- If Bitcoin’s price rises above Rs. 26,00,000, you can exercise the option and make a profit. If it doesn’t, you only lose the premium (The premium is the price you pay to buy an option) you paid for the option.

But Why Delta Exchange for Crypto Options Trading in India?

Here are the standout features of Delta Exchange India:

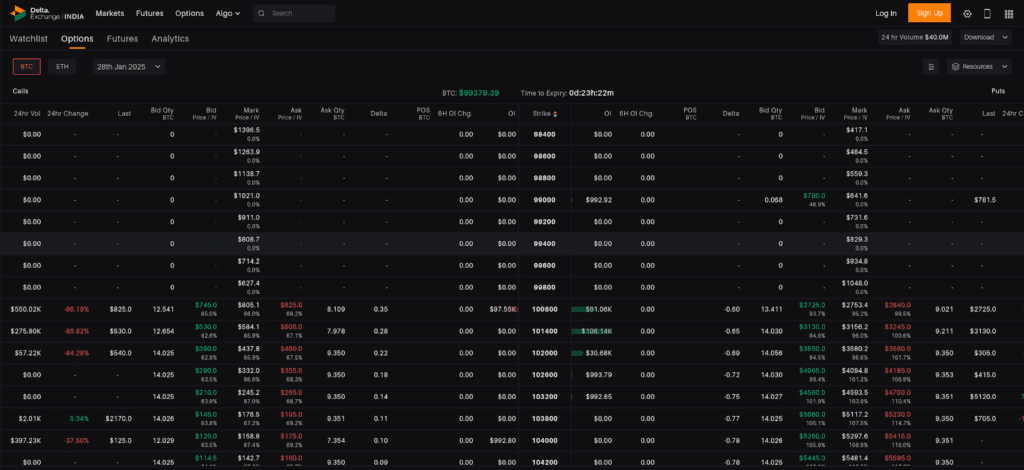

1. Wide Range of Contracts

Delta Exchange offers crypto trade options for daily, weekly, and monthly expiries, providing flexibility for all types of traders. You can trade call and put options (gives you the right to sell an asset at a specified price, which is useful when you feel the price will fall) on popular cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

2. INR Settlement

Unlike many platforms that operate exclusively USD or other currencies, Delta Exchange allows deposits and withdrawals in INR. This is a huge advantage for Indian traders as it simplifies the process of trading.

3. Small Lot Sizes

Delta Exchange makes cryptocurrency trading accessible to everyone by offering small lot sizes. For example:

- Trade BTC contracts for as low as Rs. 1,000.

- Trade ETH contracts for just Rs. 800.

4. Advanced Trading Tools

With features like:

- Strategy Builder: Helps you plan and execute complex trading strategies.

- Basket Orders: Allows bulk execution of multiple trades.

- Analytics Tools: Provides crypto analytics insights for smarter decision-making.

Traders can execute and analyze their trades efficiently.

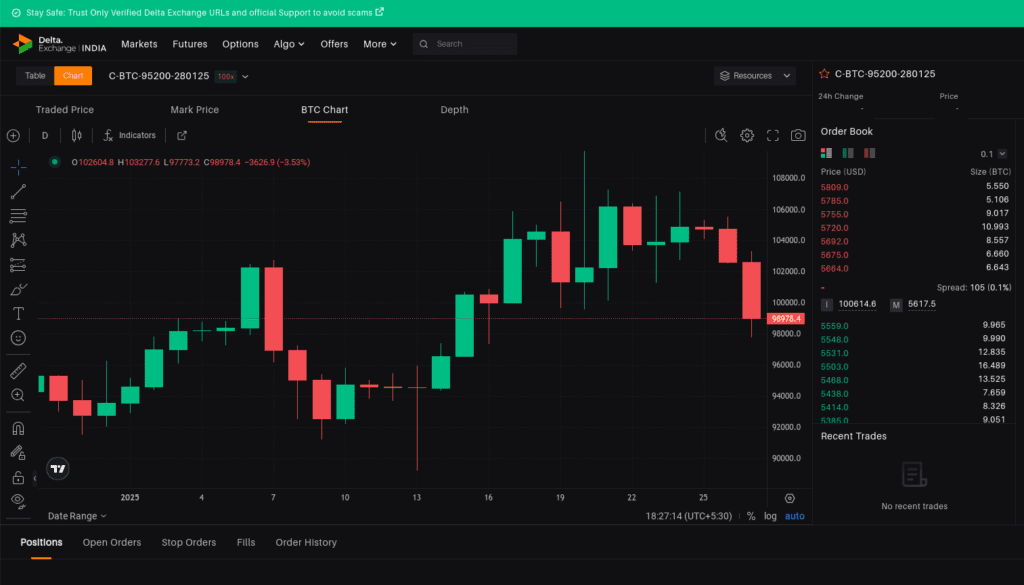

5. High Leverage Options

Leverage allows you to control a larger position with a smaller initial investment. For instance, with 100x leverage, for every Rs. 1 you invest, you control Rs. 100 worth of an asset. While this can amplify profits, it also increases your risk significantly; if the price moves against you, you can lose your entire investment very quickly.

Delta Exchange allows traders to use leverage of up to 100x for perpetual futures contracts on Bitcoin, Ethereum, and other cryptocurrencies. This can amplify your profits, but it’s important to understand the risks involved.

6. Innovative Contracts

Delta Exchange offers exclusive contracts such as:

- Option Spread Contracts: These are strategies that involve buying and selling different options simultaneously to reduce risk and improve margin efficiency. For instance, you could buy a call option and sell another one with a higher strike price, which limits your potential losses but also caps your gains.

- MOVE Contracts: These are designed for traders who want to profit from volatility without caring which direction the market moves. They allow you to speculate on the magnitude of price movements, rather than the price direction itself. For example, if you expect Bitcoin to experience large swings, a MOVE contract could be ideal for capturing profits from these fluctuations.

Benefits of Crypto Options Trading on Delta Exchange

Crypto trade options on Delta Exchange India offers several advantages:

| Feature | Benefit |

| Flexibility | Choose daily, weekly, or monthly expiries based on your strategy. |

| Risk Management | Options trading limits your risk to the premium paid, making it safer than futures trading. |

| Diverse Applications | Suitable for hedging, speculation, or capturing market volatility. |

| INR Compatibility | No need to worry about forex conversions; trade crypto options directly in INR. |

| Lower Tax Impact | Avoid the 1% TDS and 30% flat tax applicable to spot crypto trades in India. |

Start Crypto Trade Options on Delta Exchange

Delta Exchange is an FIU registered cryptocurrency derivatives exchange that is trusted by traders across the world. Users can trade call & put options on BTC & Ether along with futures & perpetuals.

Here’s how to register:

- Sign Up: Register on the Delta Exchange India platform in just 30 seconds.

- Deposit Funds: Add INR to your account through easy payment methods.

- Explore Options: Choose from Bitcoin and Ethereum options with daily, weekly, or monthly expiries.

- Start Trading: Use tools like the strategy builder and basket orders to trade crypto options efficiently.

Bottomline

Delta Exchange India has revolutionized crypto options trading by offering flexibility, advanced tools, and INR compatibility. Whether you’re a beginner or an expert, the platform makes it easy to trade crypto options and grow your portfolio.

Check out www.delta.exchange to track market trends and price movements. You can also join the conversation on X and Instagram.

Disclaimer: Cryptocurrencies are highly volatile, and investing in them carries significant risks. The content of this article is not financial advice, and we strongly recommend performing your own research on crypto options liquidity and trading before making any investment.

FAQs: Crypto Options Trading

1. Which app is best for crypto options trading?

Delta Exchange India is one of the best apps for crypto options trading. It offers a user-friendly interface, INR compatibility, and advanced tools like strategy builders.

2. What crypto options are available?

You can trade call and put options on popular cryptocurrencies like Bitcoin and Ethereum. Delta Exchange also offers innovative contracts like option spreads and MOVE contracts.

3. Is crypto exchange legal in India?

Yes, cryptocurrency trading is legal in India. However, profits are subject to taxation. Platforms like Delta Exchange operate under FIU registration, ensuring compliance.

4. Which crypto will boom in 2025?

While it’s hard to predict, experts believe Ethereum (ETH), Bitcoin (BTC), and emerging tokens with strong utility could perform well. Always do thorough research before investing.

5. How much tax is on crypto in India?

Crypto profits in India are taxed at a flat 30%, with a 1% TDS deduction on every transaction. However, with Delta Exchange, you can avoid these taxes by using INR settlement options.

References:

https://guides.delta.exchange/delta-exchange-india-user-guide/derivatives-guide/options-guide

Read Also: Router Protocol's Expanding Ecosystem Already Featured Every Big Web3 Name

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial or investment advice. Cryptocurrency investments are subject to market risks, and individuals should seek professional advice before making any investment decisions.